17th Annual Community Volunteer Income Tax Program

Program Details

Who is this service available to?

The clinic’s services are available to the vast majority of students at the University of Alberta. In addition, the clinic also serves many low income individuals from the Greater Edmonton Area.

Where?

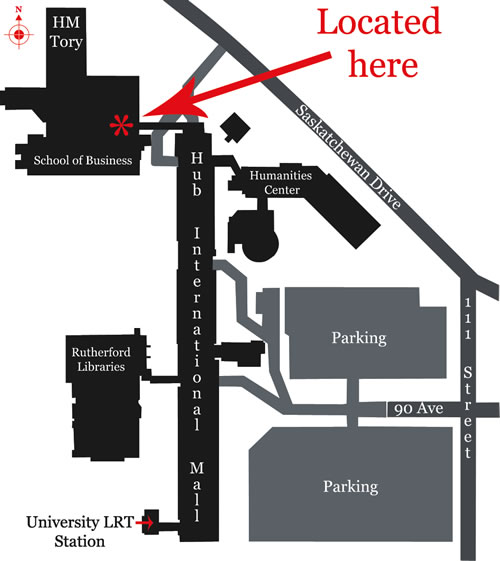

Our clinic is held in the Tory Atrium at the University of Alberta's main campus. A map can be found at http://www.ualberta.ca/~uaac/maps2.jpg

When?

This year, the clinic will run from March 5- March 24. We will be open from 9am – 4:30pm, Monday to Saturday. If a client cannot make these times, we ask that they contact us at uaac@ualberta.ca to make alternative arrangements.

What do you need to bring?

- SIN Card and one piece of photo ID

- USB flash drive, if possible

- Last year’s Notice of Assessment (NOA), if applicable

- All T4/T4A/T4A(OAS)/T4A(P)/T4RSP/T5/T2202A/T5007/RC62/RC210 slips (or any other tax slips you may have)

- Receipts for moving expenses (if you moved over 40km to be closer to school or work)

- Bus pass receipts (including U-pass)

- Receipts for medical expenses applicable to your 2011 return

- Receipts for charitable donations (must be from a registered charity)

Restrictions on Returns

Tax returns are prepared free-of-charge for clients meeting our clinic criteria. The maximum annual household income permitted begins at $30,000 for an individual, with an extra $5,000 allowable increase in income per additional person.

Tax returns will not be processed for self-employed, deceased persons, bankrupt individuals, or individuals with any of the following: capital gains or losses, employment expenses, business or rental income or expenses and foreign income.

16th Annual Community Volunteer Income Tax Program

Program Details

Our tax clinic is a free service that allows low income individuals to have their annual tax returns completed. The clinic operates as a drop-in event where clients come into our organized rooms to have their tax return processed. In addition to completing their tax returns, our volunteers also walk the clients through the tax software and often explain the different steps involved in completing their personal tax return. As a result, we help both our student volunteers and clients to gain a basic understanding of personal tax returns.Click the titles below to find out more information.

Location

What do I need to bring?

- SIN Card and one piece of photo ID

- USB flash drive, if possible

- Last year’s Notice of Assessment (NOA), if applicable

- All T4/T4A/T4A(OAS)/T4A(P)/T4RSP/T5/T2202A/T5007/RC62/RC210 slips

- Receipts for moving expenses (if you moved over 40km to be closer to school or work)

- Bus pass receipts (including U-pass)

- Receipts for charitable donations (must be from a registered charity)

What if I don't have a SIN number?

Please go to this website for more information pertaining to the acquisition of a SIN number.

What are all of these slips?

T4: This slip indicates your employment income during the year, including any deductions taken. Your employer should send you this.

T4/T4A/T4A(OAS)/T4A(P)/T4RS: These slips relate to any pension or retirement income received in the year.

T5: If you earned investment income during the year, it will be indicated on this slip. You would receive this from a financial institution.

T2202A: Education amounts are listed on this slip. It it used to determine the reduction you get in tax payable. U of A students can find this slip on Bear Tracks under "Financials" and then "T2202A Tax Form".

T5007: If you received benefits under worker's compensation or a social assistance program, you would have received this slip.

RC62: If you qualified for the Universal Child Care Benefit and received payments during the year, you would have been issued this slip.

RC210: This slip indicates advance payments received under the Working Income Tax Benefit.

Hours of operation

Restrictions

- Household income should not exceed the following amounts given a family size of...

1 person: $30,500

2 people: $37,500

3 people: $41,000

4 people: $44,000

...with an extra $3,500 for each additional person

- No investment income over $1,000

- No capital gains or foreign tax credits/foreign income

- No income derived from self employment, business, rentals, farming or fishing

- No employment/rental expenses

- The return must not be for a deceased or bankrupt individual

Unfortunately, if a community member has any transactions falling in the above restricted categories, we will be unable to process their return. In addition, UAAC reserves the right to refuse service based on items not included above.

Email uaac@ualberta.ca Phone 780.492.2993

Featured Partners

Other Partners

©2010 University of Alberta Accounting Club